Transworld Business Advisors is arguably the largest business brokerage. But are they best? Learn more in our Transworld Business Advisors review.

Wouldn’t it be convenient if you could list your business for sale on Amazon or eBay when you are ready to sell? While that strategy might work for retail products or second-hand merchandise, it is hardly a legitimate avenue for selling a commercial business. Most businesses of substance are sold by a business broker.

Better Alternatives to Transworld Business Advisors

As buyers and sellers of business ourselves, we’ve had the best sale valuation and customer service from the following broker.

What Qualities a Seller Should Look For in a Business Broker?

A business is a significant asset, so before you put it in the hands of a business broker like Transworld Business Advisors to sell, make sure you are working with the best person for your needs.

The type of business broker you want to look for would have these qualities.

They are experienced in generating an accurate valuation of your business and pricing it attractively.

They can craft a compelling narrative of your business and create a comprehensive marketing plan that effectively generates interest among potential buyers.

They have access to a proprietary list or large network of potential buyers.

They can screen through the window shoppers quickly to identify the qualified, interested buyers.

Look for a broker with enough experience and professional skills to keep guiding buyers and sellers moving forward through the business deal.

They are skillful in the art of negotiating a business deal.

Find a broker that understands the due diligence inspection process.

What Type Of People Seek The Services Of Transworld Business Advisors?

It is essential to choose the right professionals when running your business. The same principle applies when you are seeking to sell or purchase a business.

Business owners make the decision to sell their business for many different reasons. They could be looking to retire, personal or health difficulties, or simply wanting to get out from under the responsibility of being a business owner.

When a business owner wants to sell their business, there are not many options available to them. A business isn’t something you can list for sale in the newspaper or with a residential real estate agent. Business owners seeking to sell their business need a business broker like Transworld Business Advisors to locate and vet potential buyers.

Individuals decide to buy a business for a variety of reasons. They may like the idea of running their own business but don’t want to go through expenses and hard work of getting the business off the ground.

Buying an established business is less risky than starting one from scratch. Roughly 40% of startup businesses fail within one year. An established company has a proven product or service, an existing customer base, and a financial history.

To build a business from scratch, entrepreneurs must use their cash, as lending institutions won’t take the risk of a business with no history. A buyer buying an existing business can provide a bank with historical financial statements, so they are more likely to get financing.

Buying a business requires research, and due diligence that most buyers don’t have the experience or time to do. Potential buyers rely on a business broker like Transworld Business Advisors to help facilitate the process of evaluating likely businesses and franchises for sale.

Sometimes franchising can be a lucrative option for new and existing entrepreneurs.

A business owner who has developed a successful product or service may turn to franchising to create another stream of revenue.

Businesses that make good franchise candidates have:

- A successful product or service

- A concept that can be taught and shared

- An idea that can be easily duplicated in different locations

- A concept that doesn’t require excessive legal or regulatory approvals.

Franchising your business can be challenging, so it makes sense to work with an experienced franchise developer and consultant, such as Transworld Business Advisors.

Overview Of Transworld Business Advisors

Transworld Business Advisors is the leading international provider of full-service business brokerage, franchise consulting, franchise development, and commercial real estate sales.

TBA is a global network of brokers offering solutions for those individuals that want to buy or sell a business. In addition, they offer a turnkey, fully supported franchise solution for those individuals interested in building a stable business as a business broker.

With over forty years in the business brokerage business, Transworld Business Advisors has earned the distinction of being number one in the industry. There is a Transworld Business Franchise in Australia, Canada, France, New Zealand, South Africa, the United Kingdom, and the United States.

CEO Andrew Cagnetta provided the business brokerage industry experience. He started his career with Transworld Business Advisors and eventually bought the business.

Partner Ray Titus is CEO of United Franchise Group, with over 30 years in the franchising business and 1,600 franchisees globally. The two men formed a partnership and helped grow the TBA franchise to include more than 220 franchises worldwide.

Bill Luce, President of TBA, has participated for over 25 years in the sales and management of franchise and commercial businesses.

Transworld Business Advisors has been recognized as #1 in the Business Brokerage industry by IBIS World and Entrepreneur magazine. They have been recognized at one of the top global franchises, top new franchises, top home-based mobile franchises, and top Entrepreneurs Franchises.

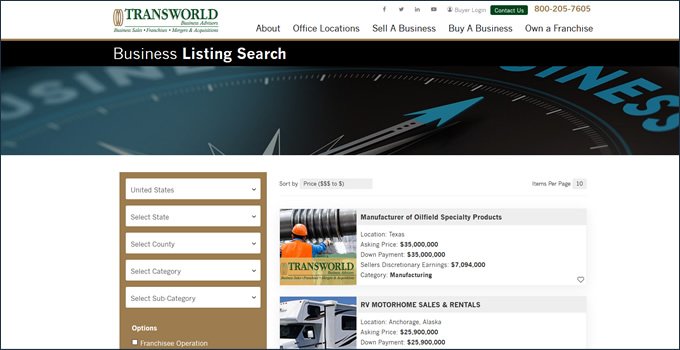

Types Of Businesses Transworld Business Advisors Sells

Transworld Business Advisor brokers have experience selling businesses of every type, whether it is a privately owned business, limited partnership, corporation, or a franchise. They specialize in established companies between one million to one hundred million.

There is no restriction on the industry within which a business operates. They have 40 years of experience selling in the manufacturing, distribution, service, retail, construction, restaurant and food provision, healthcare, technology, education, and entertainment industries.

Some of the hottest industries right now are:

- CBD. There is a high demand for creams, skincare, and essential oils containing Cannabidiol, also known as CBD . The drug elements of cannabis and hemp are removed leaving only the properties that provide anti-anxiety, respiratory relief, anti-inflammation, and pain-relief.

- Parenting Apps. With the growth in popularity of smartphones or smartwatches, parents have flocked to download apps that track everything from newborn sleeping, eating, and health tracking to teen screen time, site visits, and location tracking.

- Work and leisure clothing that can transition from the office to the gym and accessories that can carry both office essentials and gym necessities are in demand as people pursue healthy lifestyles.

- Personalization of everything from clothing choices and matching accessories to nutrition and exercise is highly sought after as people want an individualized experience.

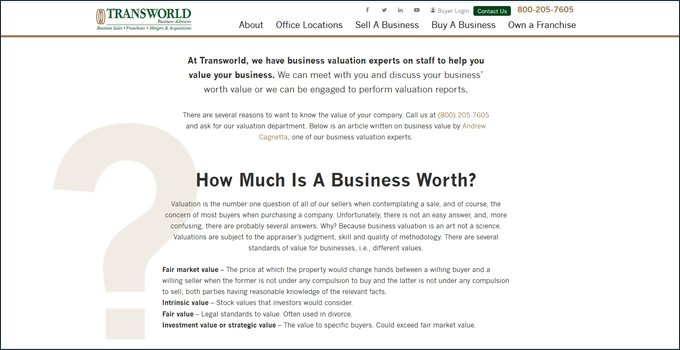

Transworld Business Advisors Valuation Process

A business is as valuable as the assets it owns and its ability to provide an income in the future for a buyer. There isn’t a magic formula or simple answer to how to value a business. A Transworld Business Advisor can help a business owner understand the potential market value of their business and help a buyer determine that value.

There are some essential things that a business broker looks at to determine a business’s worth. Examples are financial, tangible, and intangible assets. The business history, business model, competitors, and market outlook also comes into play.

Financial assets include Revenues from products and services sold, and profit margins after all expenses to make and market those products and services have been deducted. Revenues and profits can be compared to the same in similar businesses.

Tangible assets hold a specific market value and include physical assets that will be sold with the business, such as the real estate, inventory, equipment, technology hardware, and buildings or structures.

Intangible assets can have significant value and include patents, copyrights, customer lists, vendor lists, technology software, social media accounts, and brand logos. Etc.

Business history can affect the sales price of a business. A two-year-old company may not be as valuable as a fifteen-year-old business. Has the business always been profitable?

Competitors can also have an affect on the sales price of a business. Is there something about this business that sets it apart from its competitors? Does it have many competitors or just a few?

Some Business Models contain more risk than others. What is the source of the business’s revenues? Does one customer make up more than 25% of sales? A company that is dependent on one product has a riskier profile than a business with a diversified product portfolio.

Market Trends and Outlook can affect the future revenues of the business. A technology business whose income is heavily dependent on the sale of desktop computers might find it hard to compete if the majority of tech users are turning to mobile technology.

All of these assets and elements combined with any red flags like customer complaints about the business or legal issues and gold stars like a stellar reputation in the industry help determine the value of a business.

The Sales Process

Once the valuation has been determined for the business for sale, the listing price needs to be determined. As a general rule, a business will typically sell or 2 to 3 times its annual cash flow.

TBA’s brokers prepare a thorough business summary and use a detailed and aggressive but confidential marketing plan. Transworld Business Advisors has developed an extensive network of vetted buyers who can be sorted according to their specific needs.

All potential buyers are screened to make sure they are qualified to make an offer. The business broker guides the negotiations, prepares all of the necessary paperwork, and completes the due diligence investigation process to ensure the sale goes cleanly and smoothly.

Both buyers and sellers want to know how long to expect the sale process to last. There are many steps in selling a business, which takes time to work through.

After hiring the business broker, the valuation process can take some time, as financials, assets, and other elements need to be sifted through and organized. Determining potential buyer candidates, vetting buyers, and packaging information for buyers and fielding their questions can take time before an offer is received.

Any offer received from a buyer is contingent on the seller’s acceptance of the buyers’ terms and the satisfaction of due diligence inspections. After due diligence has been satisfied, final documents need to be prepared for closing.

Transworld Business Advisors Success Rates

Business brokers working for Transworld Business Advisors have sold over 10,000 businesses. Each Transworld Business Advisors office is a franchise, so actual dollar amounts of companies sold in the aggregate are not publically available. However, based on total company revenues, TBA is listed in the top 10 companies in the business brokerage industry.

Transworld Business Advisors holds a 5.9% market share in the highly fragmented business brokerage industry. Their franchises hold more listings, agents, and business brokers than any company in the industry.

Fees Charged By Transworld Business Advisors

Business brokers that work for Transworld Business Advisors typically receive a commission of 8 to 12% of the selling price of a business, depending on the size and complexity of the business. In some cases, an upfront retainer may be required.

Anything under 1 million is 10%. If the business is selling for 2-3 million range then the fee is 6-7%.

Pros And Cons Of Using Transworld Business Advisors

Pros:

- They have been in business since 2007

- They hold a leading position in the industry.

- Strong Management expertise

- Recognized by Entrepreneur magazine and IBIS World

- Transworld Business Advisors offers a free initial business valuation

- Their successful service has allowed them to franchise the concept.

- They have developed a vast network of potential buyers.

- Client reviews of Transworld Business Advisors are favorable.

Cons

- Transworld Business Advisors is a network of independent franchises, which can seem impersonal at times.

- Commission fees are on the higher side.

Conclusion And Verdict

After completing our Transworld Business Advisors review, we believe they are experts that know how to value and present your business to a buyer in the best manner possible. They have a long history in this industry and are considered in the top tier.

Having closed over 10,000 business sale transactions, they have a proven methodology that works. A proprietary network of buyers in many industries provides a read source for business sales. A strong and experienced management offers thorough training to the brokerage franchises to keep the business brand reliable.