When selling a business, it is important to carefully consider various factors. Taking small preparatory steps and following helpful tips can significantly impact the sales process in the future.

Firstly, it’s important to ensure that you are prepared to sell and to be truthful with yourself: Am I ready to go through a deal process? What do I want my exit strategy to be?

Timing can be a crucial element in making this decision. Understanding market demand and industry trends will help you know how to best position the business for a successful exit.

Regardless of their confidence level, if a seller embarks on a deal without an exit plan or proper preparation, the deal could fail.

If you feel like you need to allocate more research or gather information, start here with this guide. We’ll explore in more detail how to avoid common mistakes and achieve a successful, quick sale below.

Step 1: Determine the Value of the Business.

A business valuation is the process of determining the economic value of a business or company. This assessment is critical in setting a realistic and fair selling price, providing a firm baseline for negotiations, attracting serious and qualified buyers, and aiding buyers in securing financing, as lenders often need a professional valuation for loan approval. This process ensures the business is neither undervalued nor overpriced, streamlining the sale process.

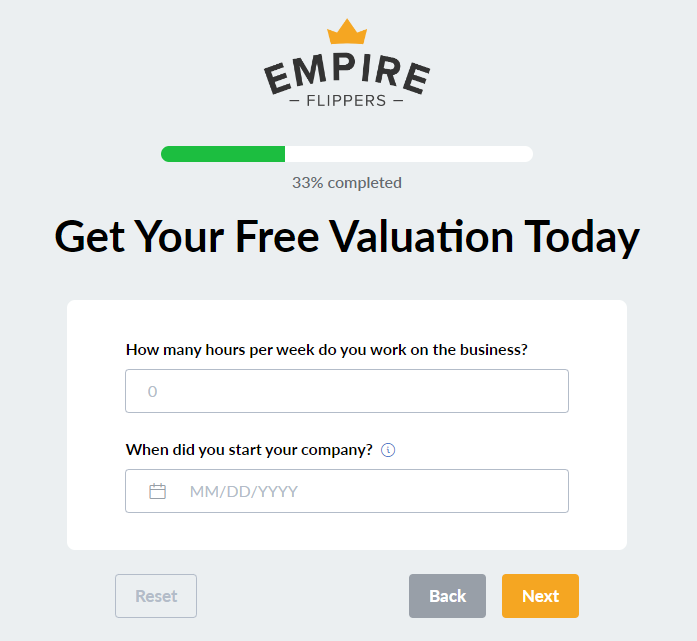

Going through the valuation process can be more tedious in offline business sales, but typically in the world of online businesses, most brokers have free, fast valuation tools available to get a baseline estimate of a business’s worth. Empire Flippers offers a free valuation tool that can provide valuable insights into how much your business is worth within just a couple of minutes.

What Goes Into a Valuation?

The valuation of a business is a comprehensive assessment of its worth. A business with negligible profits will have its valuation primarily driven by its tangible and intangible assets. For those businesses that do show profits, their value is often based on Seller’s Discretionary Earnings (SDE), which is the sum of the total sales and the owner’s income.

After accounting for all expenses related to the products or services sold and any other relevant costs, the method of valuing the business can differ based on the unique circumstances of each business. For businesses with significant profits, their valuation is often expressed as a multiple of their EBITDA.

EBITDA Defined

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization.

- Interest: The cost incurred for borrowing funds.

- Taxes: Compulsory charges levied by governments or other entities.

- Depreciation: The systematic allocation of an asset’s cost over its useful life.

- Amortization: The process of gradually paying off a debt.

Seller’s Discretionary Earnings (SDE) Explained

SDE takes into account several business financial aspects, such as:

- Post-tax profit

- Non-recurring expenses

- Non-operating expenses

- Interest expenses

- Owner’s compensation

- Depreciation and amortization

It’s important to note that events leading to a decrease in profits can encompass non-recurring and non-operating income.

When considering selling a business, engaging with a business broker can be invaluable. They provide insights and expertise in evaluating the market value of the business and guide sellers to ensure they get the most money for their business.

To prepare for a valuation, ensure all financial records are accurate and up-to-date. This includes balance sheets, income statements, tax returns, and documentation of assets and liabilities. Information on market position, customer base, and other intangible assets may also be needed. A break down of what you’ll need to prep is included in the next section.

Step 2: Sale Preparation

When gearing up to sell your business, gather financial statements and the required historical and legal documents related to the business:

Legal documents required:

- Proof of ownership, which varies based on the business’s structure.

- Income reports, profit analyses, and ROI evaluations.

- Site transfer history and past appraisals.

- If involved, real estate and intellectual property documents, such as deeds, registrations, trademarks, or patents.

- Data on the customer base and business cash flow.

More than just legal documents, you’ll really need to color in the full picture of the business for the ideal buyer. To do so, consider presenting the following to potential buyers:

- An Executive Summary: A one-page overview of the business.

- Security reports detailing systems, logs, and staff records.

- A site index with page descriptions.

- Media mentions, awards, or publicity received by the business.

- A list of employees and their records.

- Instructions for all programs used by the site.

To sell a business online, it’s essential to convert the essential information about the business into a compelling narrative that will entice prospective buyers. Create a sales pitch for your business and try to distribute it widely to target a broad audience if you happen to be selling the business on your own. In the case of working with a broker, they will do the majority of marketing the business for you.

Data you already have such as keyword history, SEO stats, visitor demographics, sales history, and competitor insights—can be game-changers for getting the right potential buyers to the deal table. Having all your information lined up and organized will allow the most business buyers possible to review your business and decide if it’s a fit for their goals.

Step 3: Find a Broker

The process of selling a business can be overwhelming and challenging to navigate, especially if you’re entirely new to dealmaking.

That’s why finding an experienced business broker who can help you navigate the process is essential. Not only do they help run the deal for you, they’re able to ensure you get more money from your business’s sale.

Below we will talk about a few broker options for you and your business to kickstart your search. Broker Options: For every price range and business model.

There are a myriad of brokers out there who can help advise on your specific deal. We talk about those options in great depth at Business Brokers Rated, but for the sake of brevity in this article, we will give you a summary of the top brokers to consider:

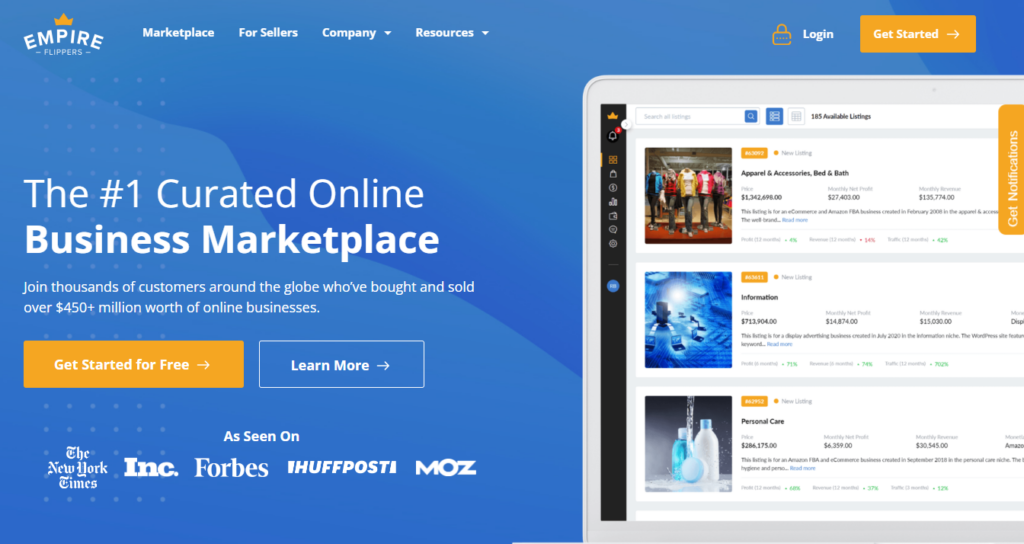

Empire Flippers: Empire Flippers is our top recommended broker for those looking to sell an online business. The reason we recommend Empire Flippers first to sellers is their demonstrated strong track record for selling a wide range of online businesses and their ability to ensure sellers get a lucrative exit.

Empire Flippers does all of the heavy lifting of running the deal for sellers and even handles migrating the business to the buyer. For sellers curious about how much money they could make selling their business with Empire Flippers, the marketplace has a free valuation tool that generates a baseline estimate of your business’s value. To best explore the marketplace and what it can offer you, you can set up your account for free here.

Acquire: Acquire (formerly Microaquire) is a membership-driven marketplace for online businesses. Acquire often uses the word “startup” to describe their listings, but that term also encompasses strong online business monetizations like e-commerce, agencies, and SaaS. SaaS in particular has been a strength of Microacquire, as they’ve become a leader in buying and selling SaaS assets in the industry.

Flippa: Founded in 2009, Flippa is considered to be the oldest platform for buying and selling online businesses. Since its inception, Flippa has sold over 300,000 online businesses. They boast one of the largest buyer networks and a range of businesses for sale, with over 6,000 listings live on their marketplace.

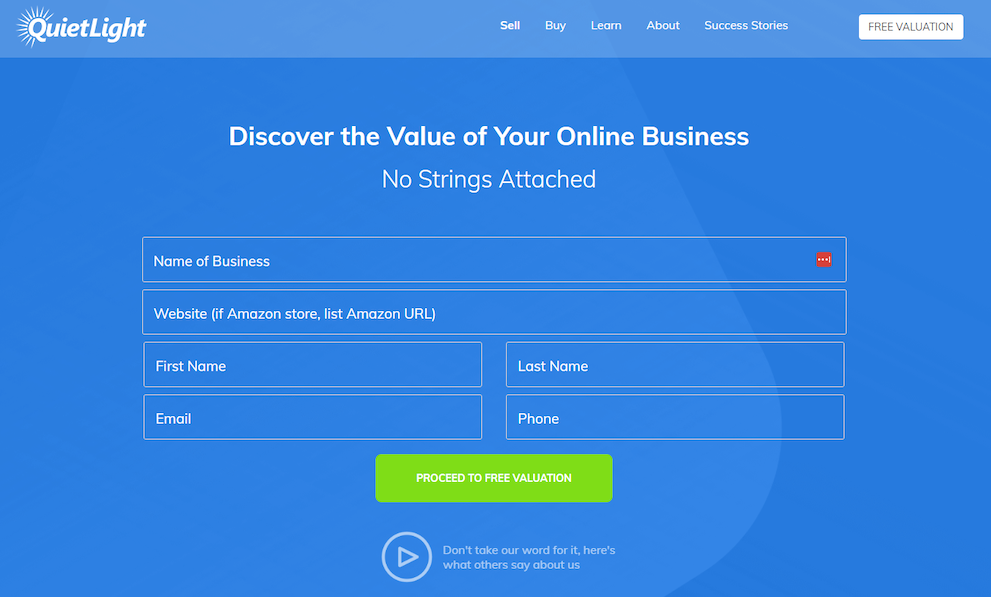

Quiet Light: Quiet Light is most renowned for its meticulous vetting processes, strong customer service, in-depth industry knowledge, and a track record of facilitating successful high-value transactions. This platform in particular is ideal of six to eight-figure online businesses for sale, as they have a strong record of selling large, complex businesses in this sales price range.

FE International: FE International shines for its detailed advisory services, strong industry understanding, and a legacy of orchestrating high-value, successful deals. As of recent updates, FE International reports a sale success rate of over 94.1% in business sales, having closed 1200+ transactions for a cumulative value of $1,000,000,000. This is another ideal broker for larger businesses, as they rarely list businesses under $250K.

For offline businesses, or traditional ‘brick and mortar’ businesses, BizBuySell is a popular marketplace for just about every business and niche you can think of.

Step 4: Put the Business on the Market

Finally listing your business on the market is a huge moment as a seller. Understandably there is excitement and nerves at play. If you’ve found an experienced broker or are working with some kind of support during the listing phase, you shouldn’t be too nervous about the deal.

The most important thing you can do during this phase is to be ready to respond to buyer queries. Buyers will be conducting due diligence process on the business, which means that they may be requesting specific information that may not be available on the list page.

Negotiations for selling a business are time-sensitive, so it is crucial to stay organized and manage all aspects efficiently. Make sure to avoid overestimating your ability to handle all tasks simultaneously, and lean on your broker if you have one.

Whether on your own or with the help of a broker, you should understand if the buyer is qualified to purchase your business. Do they have verified capital to make the acquisition? Do they have the experience to run the business based on its niche, monetization, or model? Some sellers may not be concerned by the buyer’s expertise to acquire, but most do. Ensuring the buyer is capable to run the business or able to acquire the assets means it’s more likely that all contracts and sale agreements will go through smoothly.

Step 5: Due Diligence and Important Contracts

The due diligence phase is where buyers do their own investigative work on the financials, history, and performance of the business. Typically the due diligence period can last from 30 to 120 days while the buyer ensures all details are true and the business is a fit for their acquisition goals.

During the due diligence phase, there are a couple of key documents that may come into play:

Non-Disclosure Agreement

A Non-disclosure Agreement (NDA) is a legally binding contract establishing confidentiality between two parties. In the context of selling a business, the NDA is typically signed by potential buyers, obligating them to keep the business information they receive confidential.

NDAs are important because when you sell your business, you will be disclosing sensitive information that could be damaging if leaked. NDAs protect against such risks by:

Safeguarding Confidential Information: Details about financials, client lists, trade secrets, and business strategies are kept secure.

Preventing Information Misuse: NDAs legally deter buyers from using your information for any purpose other than evaluating the purchase.

Facilitating Open Discussions: NDAs allow you to share necessary details with potential buyers, fostering transparent and fruitful negotiations.

In case of a breach, the NDA should outline the remedies or actions that can be taken. It’s crucial to ensure that the terms are enforceable under the jurisdiction governing the agreement.

Letter of Intent

A Letter of Intent (LOI) is a non-binding document that signifies a serious intention from the buyer to purchase your business. It outlines the basic terms and conditions of the sale, serving as a foundation for the final, legally binding agreement. The LOI is important because it solidifies serious intent from the buyer, provides a framework for negotiations and limits uncertainty.

The LOI typically includes:

Sale Price: An agreed-upon range or specific price for the business.

Terms of the Deal: General conditions under which the sale will proceed.

Due Diligence Period: A set time frame for the buyer to examine the business’s records and operations.

Confidentiality Agreement: Clauses to protect sensitive business information during negotiations.

Exclusivity Period: A period during which the seller cannot negotiate with other potential buyers.

Integrating the LOI into the process of how to sell a business adds a layer of seriousness and structure to the transaction. It is a pivotal document that bridges initial negotiations and the final sale, ensuring clarity and commitment from both parties involved.

Step 6: Field Offers from Buyers

Buyers usually need time to make an appropriate offer on a business and it may take a period of time and considerable communication between seller and buyer.

The completion time for this process varies, but a typical median time can be about 2-6 months for an online business. Offline businesses or multi-million dollar, complex businesses tend to have longer sale timeframes. However, some businesses, especially in the online space where the deal process is maximized for speed could take as little as 30 days or less.

Multiple offers may come in for the business so it’s important to weigh out each deal structure carefully. Selling the business to the biggest bidder isn’t always the recipe for success. Consider which buyer is the best to work with, or if they bring any other benefits to the deal that transcend just cash in hand (i.e. extra performance-based bonuses after purchase in exchange for a lower sale price). This is where having a broker or support system on your deal will be helpful.

Step 7: Finalize the Sale.

Closing the deal involves ensuring that all final details are fully agreed upon and contracts are signed. Brokers play a role in this process by ensuring each party abides by contracts and the organized procedure of the deal process.

The deal is considered complete after the seller is paid and the business is successfully transferred to the ownership of the buyer. In online business, there is a standard procedure for this called migrations. Migrations is a multi-step process of breaking down each element of a business, from domain ownership to affiliate referral links, and transitioning them into the buyers’ name. Once each piece of the business has been moved over, the seller is paid out from a secure payment service like Escrow and the business becomes officially the buyer’s.

Looking for Guidance?

If you’re an online business owner looking for help navigating the acquisition process, Acquiring Digital offers free discovery calls to ask questions and find answers about every part of the exit process and acquisition journey.