Flippa is a reputable online marketplace for buying and selling businesses, attracting a wide range of sellers and buyers.

However, it’s important to approach this platform with a discerning eye. By following the right strategies and being aware of potential scams, you can successfully navigate Flippa and find a business that aligns with your goals and aspirations.

In this article, we will share valuable tips and insights to help you make informed decisions and avoid common pitfalls on Flippa.

What is Flippa

Founded in 2009, Flippa is considered to be the oldest platform for buying and selling online businesses. Since its inception, Flippa has sold over 300,000 online businesses.

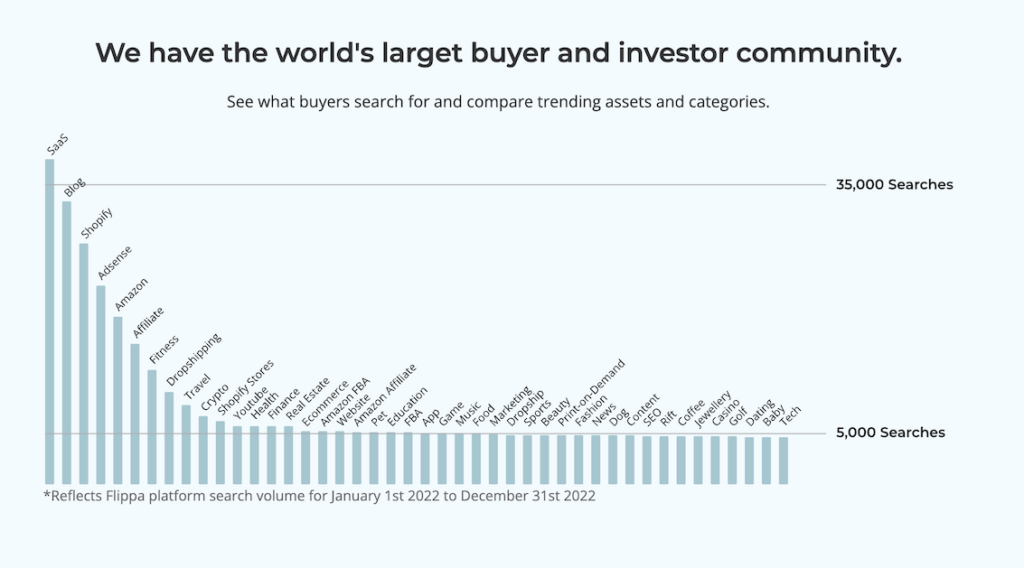

Flippa boasts a buyer and investor community with over 600,000 individuals, companies, private equity firms, venture capitalists, and family offices on their platform. This extensive network ensures that sellers have access to a wide pool of potential buyers, increasing the chances of finding the right acquirer for their business.

Flippa is an open platform for buying and selling online assets, meaning listings typically aren’t vetted prior to being listed on the marketplace and most deals are facilitated between buyers and sellers.

That being said, Flippa is growing and changing rapidly. They now offer paid services for M&A advisory as well as due diligence support and are creating more in-platform teams to make buying or selling your business a stress-free experience.

What Types of Businesses Does Flippa Offer?

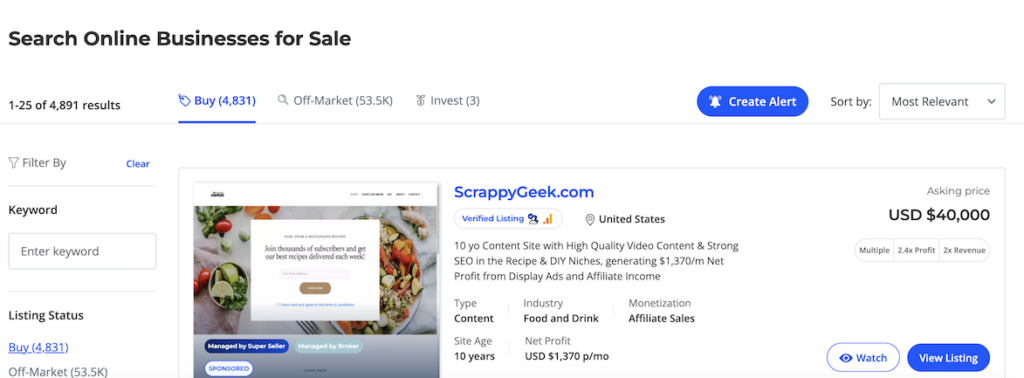

With over 6,000 listings currently on Flippa’s marketplace, there’s a business for the pickiest buyers. The majority of assets available to buy on Flippa are websites ranging from affiliate websites, e-Commerce sites, and Amazon FBA sites.

For buyers looking for a specific niche, they are likely to stumble across a listing on Flippa. This is perfect for buyers with a tight list of buying criteria as it’s possible to filter listings on Flippa’s platform.

Outside of popular online business monetizations, you can also buy mobile apps and domain names, making Flippa a one-stop shop for online business buyers.

With a price range from just a couple hundred dollars up to over $10M, Flippa offers acquisition opportunities to newbies and experienced private equity buyers alike.

Buying a Business through Flippa

Fees and Pricing for Buyers

Registering as a buyer with Flippa is completely free. Once you register and set up your account, you’ll be able to scour Flippa’s websites for sale.

Best Practices for Buying from Flippa

Thinking of buying a business with Flippa but don’t know where to start? Flippa has put together an extensive buying guide for first-time buyers that outlines the entire buying process.

If you don’t have time to go through an entire guide, here’s our own summary of buying best practices on Flippa:

1. Start by understanding the personal value of purchasing an online business and why it makes sense as an investment for you. Know your goals and use them to inform your buying criteria.

2. Familiarize yourself with different types of online businesses available on Flippa, such as blogs, eCommerce stores, SaaS businesses, dropshipping websites, etc. Get a sense of what you’re looking for and what your personal ‘green flags’ and ‘red flags’ are.

3. Consider your competition on Flippa, including first-time buyers, sellers, and experienced investors. Understand who you might be bidding against.

4. Determine your budget and what you’re comfortable spending on a business. Keep in mind that no business is truly passive, so allocate extra funds for reinvesting in the business.

5. Look for an online business that aligns with your subject matter expertise. Consider opportunities where you can leverage your skills to increase the value of the business.

6. Choose a business that interests you and excites you. Working in an industry you enjoy will make the ownership experience more fulfilling, and likely translate to a better long-term investment.

7. Understand the typical purchase prices for different types of online businesses. On Flippa, content sites sell at an average of 1.95x annual profit multiple, eCommerce stores at 1.85x, SaaS businesses at 2.7x, and starter sites have subjective value based on potential.

Finding the Right Business on Flippa

Now that you have an understanding of the buying process, you can start your search on Flippa:

1. Set your saved searches and alerts on Flippa to receive notifications about listings that match your criteria. This will save you time and help you find the right business.

2. Fill in the criteria you’re looking for in a business, such as industry, revenue, traffic, etc., to set up your saved searches and alerts effectively.

By following these steps, you’ll be well-equipped to navigate Flippa and find the perfect online business to purchase.

Due Diligence Process with Flippa

Flippa doesn’t have a built-in vetting process to list on their marketplace. Anyone is able to list on the marketplace and due diligence falls on the buyer to conduct on listings of interest.

They do provide some content surrounding due diligence best practices for buyers. Flippa’s due diligence checklist suggests verifying a few of the following metrics before buying a site:

- Business model

- Whois history

- Get to know the seller

- Plagiarism check

- Monetization

- Revenue account transferability

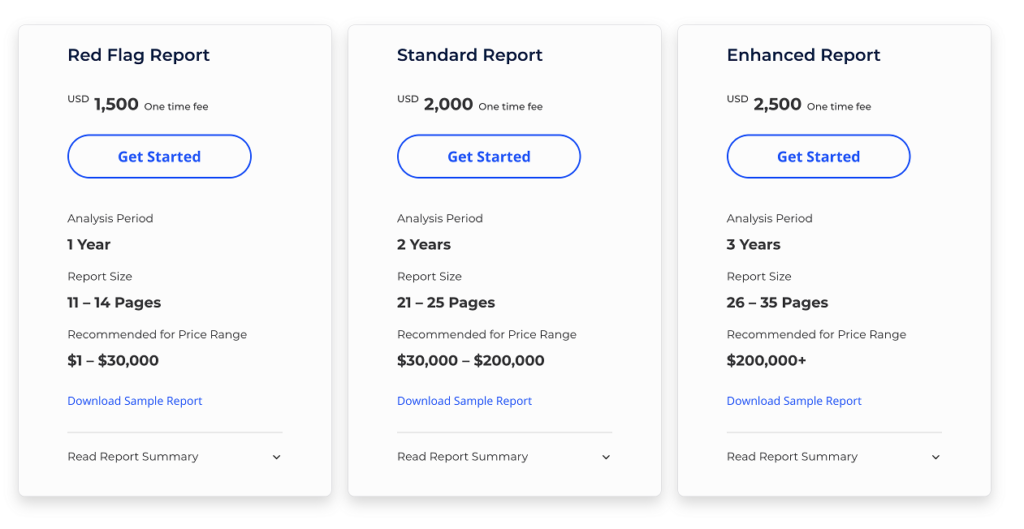

Flippa now offers an in-platform paid due diligence service for those wanting more support during the buying process. They offer three levels of service for due diligence with different levels of support.

Here are Flippa’s three different pricing plans for their due diligence services:

Selling Your Business with Flippa

Fees and Pricing for Sellers

Flippa does charge a listing fee to list your asset on their marketplace. They have a flat rate of at least $49 to list on their marketplace but for more services, Flippa charges a tiered pricing structure.

If your website price is listed for $1-$9999 then you will have access to two different listing packages, standard or enhanced. No matter the package you choose, you’ll still have to pay a 10% success fee (a portion of your listing price that will be due to Flippa upon completion of the sale).

If your website’s listing price is higher than $10,000 then you’ll have access to their premium, standard, and ultimate listing plans.

If your business is bought on Flippa you’ll have to pay a commission fee to Flippa based on the final sale price.

Flippa’s sale commission is as follows :

- $1-$49,999 = commission will be 10% of the sale price.

- $50,000-$99,999 = commission will be 8% of the sale price.

- $ 100,000-$249,000 = commission will be 6% of the sale price.

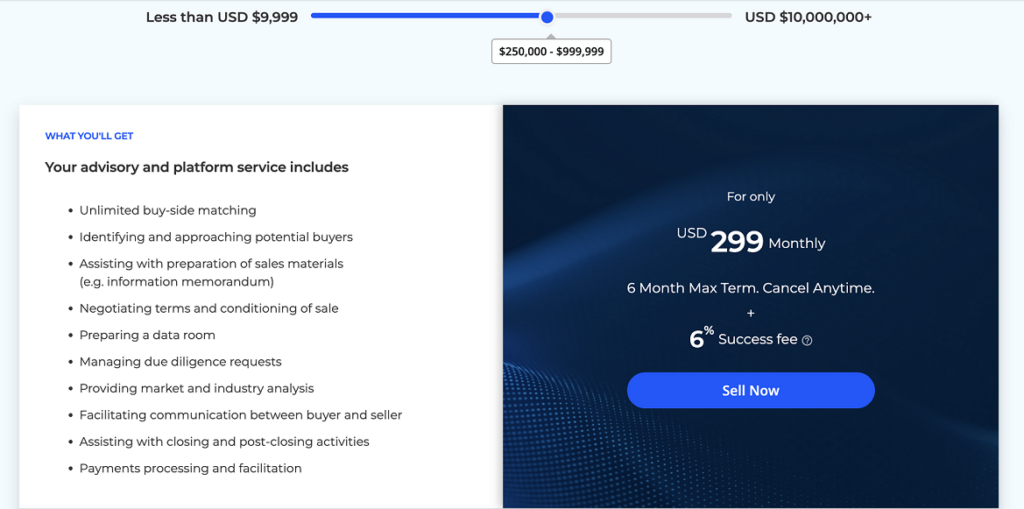

For assets priced over $250,000, sellers will have a certified M&A Advisor who will personally manage the sale process. Below are the terms of the package and what sellers can expect to get from Flippa’s M&A service:

All businesses above $250K qualify for Flippa’s M&A program. However, there is good news for sellers: as the list price increases, Flippa’s sale commission decreases. Here is how the commission above $250K breaks down:

- $250,000 – $999,999 = commission will be 6% of the sale price.

- $1,000,000 – $4,999,999 = commission will be 5% of the sale price.

- $5,000,000 – $9,999,999 = commission will be 4% of the sale price.

- $10,000,000 and above = commission will be 3% of the sale price.

Businesses priced below $999,999 will pay $299 monthly to list their business with Flippa for a maximum six-month term. Any business listed above $1,000,000 will have to pay $499 monthly to Flippa to list their business and be a part of the M&A program.

Listing Your Business with Flippa

To sell your business with Flippa, follow these steps:

1. Sign up on Flippa: Create an account on Flippa’s website to access their platform services.

2. Prepare your business: Gather all the necessary information about your online business, including financial and operational performance, audience size, and any other relevant details.

3. Get a Valuation: To get a sample valuation with Flippa, you can start by using their free valuation tool. By submitting information about your website such as the URL, domain history, organic traffic data, and when the business was started the tool then automatically generates an estimated business value.

Your website must be at least 12 months old to use the valuation tool as websites under a year old aren’t established enough to get a reliable estimate.

Upon submitting your business for sale, Flippa will create a more extensive valuation based on data such as monthly income, expenses, and any other relevant information. The details and final valuation will go on the listing page for buyers.

4. Create a listing: Use Flippa’s platform to create a listing for your business. Include all the relevant details and information about your business, its performance, and potential growth opportunities.

5. Negotiate with buyers: Flippa’s marketplace has a global buyer base, including individuals, companies, private equity, and family offices. Respond to inquiries and engage with potential buyers to negotiate and discuss the sale terms.

6. Close the deal: Once you’ve found a suitable buyer and negotiated the terms, complete the necessary legal documents and transfer the assets and funds via a secure method like Escrow.

7. Pay success fees: Flippa charges a success fee starting from 4% of the sale price for their services.

Remember, the period of time it takes to sell can vary depending on the price and category of your business. Flippa mentions on their sale page that listings can sell in as little as 48 hours, but they also include the following average sales timeframes to set expectations for sellers:

- Up to $250k – 2.5 months

- $250k to $1MM – 3.5 months

- $1MM plus – 5 months

Marketing Businesses for Sale

Flippa has an audience of millions, so simply listing the business on their marketplace should give valuable buyer exposure. Actual marketing services, however, come at an additional price on the marketplace:

- Businesses Listed Under $50k: Getting boosted search results or featured on the home page with Flippa’s Ultimate or Premium packages will cost an additional $399 – $499.

- Businesses between $50k – $249k: Ultimate and Premium packages cost increases to $499 – $599

Above that threshold the “Managed by Flippa” option comes into play and marketing would be built in to the monthly costs and sales commission.

FAQs About Flippa

Is Flippa Legit?

Flippa is an entirely legit marketplace for buying or selling a digital business. They have closed 12,000 deals annually and support deal sizes up to 8 figures.

That being said, Flippa’s open marketplace leads to the need to be careful when facilitating deals. Scams tend to be more common due to the sheer volume of listings and lack of vetting.

Extra care around due diligence should be taken, especially when dealing directly with a buyer or seller on legal matters and transferring assets. But with a bit of common sense, you should be able to avoid any potential issues.

Does Flippa Offer Post-Sale Support?

There is no post-sale support built-in on Flippa’s platform. If a seller or buyer would like support post-sale, they will need to organize those terms within their deal contract.

Who Handles the Migration of the Business?

Flippa does not handle the asset migration process so the responsibility of migrating the business is on the seller and buyer to figure out.

What Payment Methods Are Accepted For Buying a Business?

Flippa automatically partners with Escrow to ensure the safety and security of transferring funds. On small deals, PayPal payments are accepted though Flippa suggests using Escrow in most instances. Generally, wire transfers from banks are the most popular way of paying for businesses.

Pros and Cons of Using Flippa Buy or Sell a Website/Online Business

Pros of Using Flippa

Large Buyer Pool and Audience Reach

Flippa claims to add more than 17,000 new buyers to their audience every month. They already boast an audience base of millions and an email list of +360,000 ready to be marketed to. This is important for sellers who want a high degree of exposure for their listing to a wide audience of interested, engaged buyers.

Wide Range of Businesses Listed for Sale

Almost every type of business model and niche can be found on Flippa. Whether you’re interested in e-commerce, content sites, mobile apps, or service businesses, you’ll find a wide selection of listings on Flippa that are likely to hit your buying criteria. As long as you’re an experienced acquirer who knows how to spot a trustworthy, solid business, Flippa’s marketplace is great for finding hidden gems that may not exist on other platforms.

Customizable Deal Process

The baseline deal process on Flippa is to place all parts of the deal, from listing to migrating a business on the shoulders of the buyer and seller. But that is now changing.

Flippa offers a range of services depending on deal size that allows buyers and sellers to tap into support should they need it. Want help with due diligence process? Flippa now offers three tiers of due diligence reporting. Need a skilled advisor to help with negotiations? If your deal is worth more than $250k, Flippa automatically assigns you an M&A advisor. Of course, if you want to be completely independent, you can do that as well while utilizing the abundance of content Flippa has created to support buyers and sellers throughout the deal.

Ultimately the user experience for online business owners is fairly easy and straightforward on the marketplace, giving sellers and buyers the ultimate freedom to construct their own deal.

Cons of Using Flippa to Buy or Sell a Website/Online Business

Presence of Scam Listings on the Marketplace

Flippa may be an open marketplace, but that also leaves its listings open to scams. There are plenty of listings out there that are either poor in quality or have scam potential. Blatant scams might come in the form of huge unverifiable traffic jumps or even a seller not passing over all the assets belonging to the business. Since so many other brokerages vet listings and create a trusted marketplace, Flippa’s reputation for hosting some scam listings makes it stand out in the broker space. Of course, solid due diligence could circumnavigate any potential scams but understanding what to look for (and being good at doing so) then falls on the shoulders of the buyer.

Lack of Deal Support

Some sellers and buyers may love the independence of doing deals with Flippa, whereas others would really appreciate the guidance of an M&A expert during their deal. Flippa does have some seller support, but it only kicks in on businesses valued above $250,000. For all other deals, sellers and buyers are on their own to figure out how to run the deal entirely themselves.

No Migration of Businesses

Migrating a business correctly can be a make-it-or-break-it part of the deal for buyers and sellers. Money or assets can be damaged or lost during migrations so it’s critical this is done correctly. Flippa offers no support for migrating businesses, so those who want broker support should look towards other marketplaces (like Empire Flippers).

The Final Review: Is Flippa a Good Option for You?

Flippa can be a great place to find hidden gems — if you know what you are doing.

Flippa really is best for professional buyers who know how to thoroughly vet potential acquisitions and understand how to uncover growth potential in an online business. For those who are more veteran buyers, Flippa is an excellent source of undervalued businesses prime for flipping.

For sellers, Flippa offers a pretty straightforward listing experience but most of the work falls on you to conduct. If you’re a seller who wants to set your own deal terms, Flippa’s independent marketplace may be ideal for you.

For buyers or sellers looking for vetted listings or M&A support, we recommend other brokers, like Empire Flippers, who curate listings and offer deal assistance. If you’d like to speak to someone for bespoke M&A deal guidance, set up a call with Acquiring Digital for expert guidance.