Dealflow is a broker of online businesses that was founded in 2013. They began as a brokerage that dealt exclusively with the listing service, Flippa. In 2017, they branched out on their own and have been brokering deals ever since.

With such a long list of things to take care of when selling your business, it’s nice to have partners. By hiring a brokerage like Dealflow to handle the sale of your company, you can focus on your next step. In business, there’s nowhere else to look but toward the future.

Selling a business that you have put your heart and soul into can be a daunting task. It doesn’t matter if you are retiring or moving onto your next venture. The logistics of handing off your company to someone else would make anyone apprehensive.

Luckily, there are services and brokers who will take on the nuts and bolts of your business sale for you. They can perform analytics that will maximize your company’s worth and have a wide buyer pool. These things alone could be a good enough reason to hire a broker.

Any business owner knows that you are only as good as the people on your team. Having this kind of approach when selling your business might be a good idea, as well. Trying to go it alone could lead to some major setbacks.

UPDATED: May 2024

Our Overall Rating

Overview of Dealflow

The cost and time that it takes to sell a business can be enough to make anyone’s head swim. It is hard enough to build a business but selling it can be even tougher. There are a lot of angles to consider and factors that should be taken into account.

Dealflow works with small to midsize businesses usually worth under one million dollars. This small business niche makes them desirable for all kinds of web-based companies. The beauty of the internet is it is equal opportunity and the same goes for online commerce.

Dealflow has a team of Mergers & Acquisitions brokers who specialize in transferring ownership of businesses. Having this team behind you during your sale is a home run since they have so much experience in the matter. Most entrepreneurs sell a few businesses in their life, at most. Dealflow’s brokers have sold hundreds.

One of the questions you may have at the start of this process is whether your business is ready. It might seem like a good idea to sell but if you’re not getting high value, it’s best to wait. Dealflow brokers can help you make an informed decision.

Another tough aspect of selling your online business is finding the right buyer. Since Dealflow has a built in network of buyers, your options are much more varied. Lead generation is the secret to any successful business venture and that includes a business sale.

Types of Businesses Dealflow Sells

Like many other online website brokers, Dealflow works specifically with web-based companies. This specialization allows them to pick the right buyers for each business. The buyers in Dealflow’s pool are already well versed in e-commerce. This helps assure a smooth transition and preserves your company’s legacy.

Dealflow works with e-commerce, SAAS, online services and more. If your business deals exclusively online, it will fit in with the rest of their listings. This gives buyers a larger pool of options when looking for new opportunities. It also means there is less competition since they are open to all kinds of companies.

One of the things that separates Dealflow from the other online business brokers is its size. Even though they have sold many businesses over the years, they only deal with 10-15 at a time. It may take longer to get your business listed but you will have less competition in the sale.

One of the types of companies that Dealflow works with is content sites. These could be blogs, online magazines or any other type of digital media. This opens up Dealflow’s services to so many more companies. If your business deals in providing content, Dealflow might be a good option for you.

For the most part, if your business is based on the web, Dealflow knows how best to find a buyer. Trusting that part of the process to professionals with connections is a no brainer. It’s hard enough to sell a business without worrying about generating the right leads.

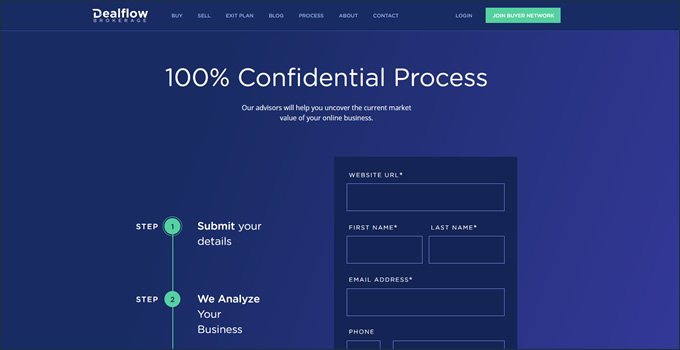

Dealflow Valuation Process

The most important first step in selling your company is to go through Dealflow’s valuation process. This process will help Dealflow understand where your company is financially. By getting a thorough, professional valuation, you can be informed. That will go a long way in getting everyone the best deal.

The first step of the valuation process is to gather up your financial materials. Providing details such as a Profit and Loss Statement and Owner Questionnaire gets things started. From there, the brokers at Dealflow will start to put together the value of your business.

One of the things that sets Dealflow apart from other brokers is their flexibility. There is room for negotiation in the valuation process. Dealflow sees it as a team effort so you are involved from the beginning. This helps give you some control over your business’s valuation.

Dealflow’s turnaround time on valuations is one of its best aspects. Once all your paperwork is complete, Dealflow usually can get you your valuation within one business day. This fast process allows you to make decisions quickly and not waste any time.

After the valuation, if you are happy with everything, you will enter into an EBA, or Exclusive Brokerage Agreement. This agreement lasts for 90 days, during which you will be contractually tied to Dealflow. Most businesses, however, sell within the first 60 days.

Sales Process

One of the most impressive things about Dealflow is that they actively source buyers for your business. They maintain a pool of buyers and know what they are looking for and for how much. They then approach these buyers privately to give them a first crack at your company.

This pool of buyers is specifically tailored to your business during the valuation process. Part of the valuation is identifying what market your company will best sell in. Since Dealflow has so many buyers under their belt, there are good odds you will find the right one.

Part of Dealflow’s service includes a complete marketing package for your business. They take care of all the materials that will best suit the buyer pool. They know the right kind of information and copy to use. That is a huge benefit to them having their own, specialized buyer pool.

They also provide you with a detailed sales strategy tailored to you. They will discuss it with you at length and make sure that prices and terms are up to your standard. This includes promotional activities and a pricing strategy. You will sign off on all of this before your campaign begins.

The entire sales process could take anywhere from days to months. As stated before, the EBA contract is for 90 days. If you are not satisfied and have not sold your company by then, you can move on. This gives you the freedom you need to feel like you’re not locked into anything you can’t get out of.

Dealflow Success Rates

Dealflow is able to boast a relatively high success rate. Although they do not disclose specific numbers, the list of companies they have sold is massive. There are a lot of things that factor into a successful sales campaign.

One of the things that gives Dealflow such a high volume of sold businesses is its vetting process. For both buyers and sellers, there is an extensive qualification process. This ensures that there are no scams or frivolous offers. This protects the seller, the buyer and Dealflow.

Dealflow will also do more than just list your company on its website. They offer rounds of prospect pitching and marketing as well. They take an active role in the sale instead of just sitting back and letting it speak for itself. Your company might be attractive enough on its own, but marketing is always a good idea.

Since the process is so tailored and specialized, you will start to receive offers right away. This will allow you to have a wide variety of buyers to choose from. The wide net contributes heavily to a high success rate. Sometimes, business is just a numbers game.

If your company has gone through the valuation process, there is no reason it will not sell. Dealflow knows their buyers well enough to know if something is a good fit. This is yet another reason to not try to sell your company on your own. Without proven success, you are flying blind.

Fees Charged by Dealflow to Sell a Business

Most brokers are going to charge about 10-15% to take on the sale of your company. Dealflow is no different, so there is definitely going to be a percentage that they take. The good news is, brokers don’t take their cut until your company sells. This significantly reduces your risk as a seller.

Even though you may have to share some of the profits with Dealflow, there are many advantages. Odds are that you are not a professional broker with years of experience in selling businesses. You have probably been busy running your own. Hiring a professional could save money in the long run.

By taking advantage of Dealflow’s buyer pool, the extra cost could pay for itself. The more likely you are to find a targeted buyer, the bigger the sale. Niche specialization makes more money in business, and finding those customers is no different.

Dealflow will also help you to develop an exit strategy for handing over the virtual keys to the store. This can be worth its weight in gold since knowing what your next step is can be the hardest part. A little bit of guidance for yourself and your company can ease the pain of the broker fee.

Another fee associated with selling your company is the escrow fee. It costs money to keep the funds for your sale secure. By paying this escrow fee, though, you are ensuring that the funds are safe. This can give you some peace of mind.

Anyone who has made it to this point knows that you have to spend money to make money. Giving up a bit of your potential sale is a reasonable sacrifice to make for that security. If you look at it as a fee for your piece of mind, it becomes clear that it’s worth it.

Pros and Cons of Using Dealflow

Pros:

- Large buyer pool – Dealflow has a huge network of buyers who are looking for their next venture. Getting your company in front of them increases your odds of a lucrative sale. That pool alone makes hiring them worth the broker fee.

- Help with exit plan – Dealflow will work with you to figure out the best moves for transferring ownership. They understand that it’s a difficult transition and can offer guidance. Having a helping hand increases your odds of success.

- Professional marketing package – Most other brokers will help you with materials but not necessarily build you a whole strategy. Dealflow has an in-house marketing team to help you with that. By having their help, you can be sure to have an attractive listing that yields a high ROI.

Cons:

- Long EBA – Dealflow’s Exclusive Brokerage Agreement is longer than some of the other brokers. By signing it, you are beholden to Dealflow for three months. The odds are that you will sell by then, but if not, you could be stuck for a long time.

- Broker controlled – Dealflow has a particularly “broker based” business model for their sales. The individual agent has more freedom than at other brokers as far as decisions go. This means you will have to be sure that the broker you work with is a good fit.

- Inconsistency – Due to the broker to broker nature of the process, quality can be inconsistent. The individual freedom given to each agent means that it’s going to be important to be heard. By voicing your concerns to your broker, you ensure that they know what you need and keep that message consistent.

Conclusion And Verdict

Out of all the online business brokers, Dealflow has one of the biggest catalogues. Even though they are relatively new, they have a lot of experience. This experience is what you are paying for when you hire a broker.

Whether you think you are ready or not, getting a valuation for your business could be a good idea. It is fairly low risk and could give you valuable information on the state of your company. By knowing its value, you can make decisions for its future going forward.

Dealflow’s relationship with Flippa is another reason it is at the top of the heap. They have a rich history of business brokerage that goes back a long way. This wealth of experience can’t be bought or sold.

If it turns out that your business is ready to be sold, the nice thing is your work is done. After that, you can sit back and let your broker take care of the rest. It is a rare thing as a business owner to be able to truly sit back. There is no better time to finally do it than at the end of your journey.

Even though there are a few downsides to selling your company with Dealflow, the benefits are many. As a business owner, there are always going to be pros and cons to weigh. Only you can truly make the decision to sell or not.

Whether you are retiring or just moving on to your next business, Dealflow knows how to handle the process. By delegating it to industry professionals, you are doing yourself and your company a huge favor. With all that extra energy, you can start thinking about your next big step.

The primary differentiator between Dealflow and their competition is their active outbound brokerage service. Most of their competitors send out the marketing prospectus to their list of buyers and passively wait for inbound leads.

At Dealflow, they use a two-pronged approach. Their marketing team compiles a list of potential strategic buyers and actively conducts outreach to find potential buyers for the business. In addition, they send their marketing materials to their extensive list of potential buyers to generate inbound leads.

By combining both outbound and inbound brokerage, they increase the likelihood of finding a suitable buyer for a business.